The Nice American Land Seize: International Invaders, Blue-State Refugees, And The Assault On Reasonably priced Housing – JP

Please Follow us on Gab, Minds, Telegram, Rumble, Truth Social, Gettr, Twitter, Youtube

Displaced Floridian, a Real Estate Realist

In a nation built on the promise of the American Dream—where hard work should buy you a slice of land and a roof over your head—that dream feels more like a nightmare these days. I know because I lived it. Just last year, skyrocketing prices forced me out of my beloved Miami Beach home and into the quieter confines of Alachua County, Florida. I thought I’d escape the madness, but even here in Gainesville, new houses pop up like weeds—drawing in more outsiders and inflating costs all over again. This story isn’t just my story; it’s a symptom of a broken U.S. real estate market plagued by high interest rates, bloated prices, and criminally low supply. But dig deeper, and you’ll find the real culprits: waves of migrants from blue states fleeing their own policy disasters, and foreign buyers—often from restrictive regimes or flush with dubiously acquired wealth—snapping up properties while locking Americans out of their markets. It’s time for reciprocity, restrictions, and a reality check. If I can’t buy land in your country without jumping through hoops or facing outright bans, you shouldn’t get free rein here. And if your fortune comes from siphoning U.S. aid through graft, keep your hands off our soil.

The American Dream Deferred: A Market Rigged Against Working Families

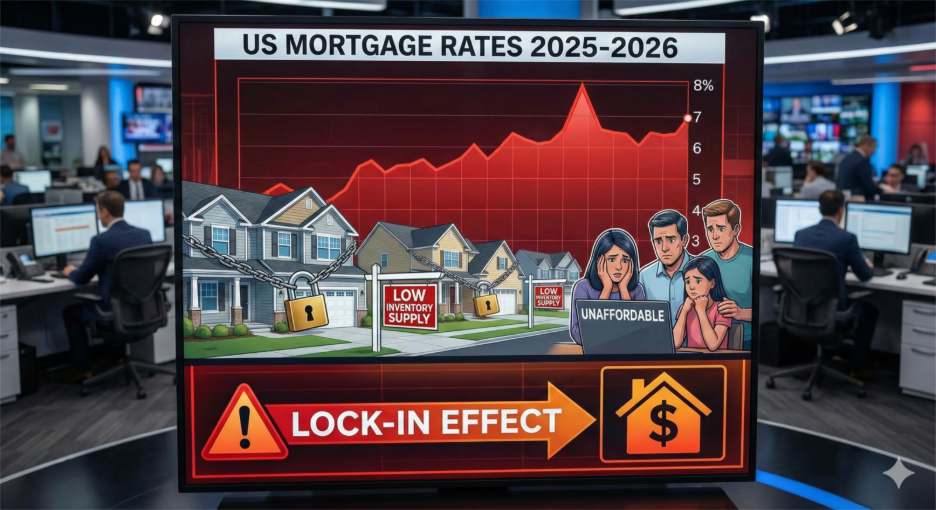

Let’s start with the basics: The U.S. real estate market is an economic dumpster fire. Mortgage rates are still well over 6% throughout 2025, a slight dip from 2024’s 6.7%, but still a gut punch for anyone trying to borrow (https://www.freddiemac.com/pmms). The Federal Reserve’s final rate cut in late 2025 brought short-term rates down to 3.5-3.75%, but as politically motivated Fed Chair Jerome Powell bluntly put it, “housing will be a problem” for the foreseeable future, thanks to lingering affordability woes. Home prices? They inched up 2.1-4% nationally this year, building on the pandemic-era explosions that have left median values out of reach for first-time buyers (https://www.redfin.com/us-housing-market). Supply remains the killer—critically low in hotspots due to the “lock-in effect,” where homeowners with those sweet pre-2022 sub-4% mortgages refuse to sell and face today’s higher costs, strangling inventory. This effect creates a vicious cycle: High rates scare off builders, low supply jacks up prices, and buyers get squeezed. President Trump’s promised “aggressive” reforms for 2026 might help, but let’s be real—it’s too little, too late for families like mine who’ve already been priced out. We’re not talking abstract economics; this is families uprooted, dreams deferred, all while speculators and outsiders feast.

From Beachfront Bliss to Rural Reality: My Exodus and Florida’s Invasion

My move from Miami Beach to Alachua County was no vacation—it was survival. In Miami-Dade, prices have gone astronomical since 2020, with the median hitting $553K in November 2025, down a measly 2.2% from last year but still up massively overall. UBS ranked Miami as the top housing bubble risk for the second year running in 2025, with values surging 40% from 2020-2022 before moderating to 7.8% growth through September . Who’s fueling this? Call it the Great Florida Land Grab. Domestic migrants from blue states like New York, California, and Illinois poured in, with Florida netting 637,000 interstate movers in 2023 alone—the highest in the U.S., though inflows halved by 2025 as costs bit back (https://www.census.gov/topics/population/migration.html). But foreign “invaders” amplified the chaos: In 2023, Florida welcomed 72,850 international residents (0.3% of population), many from South America (think Venezuela, Brazil, Argentina), Canada, and wealthy socialist Western European spots like the UK, France, and Germany. Florida’s population grew 8.2% since 2020, the fastest nationwide, with 1,271 migrants per 100,000 residents from 2023-2025 under Biden-era policies. Even in my new haven of Alachua County, the pressure’s on. New developments are booming—think a 149-home subdivision near Newnans Lake approved in May 2025, or plans for 1.4 million square feet of industrial space off Waldo Road. There are 365 new construction homes listed county-wide, with projects like Oakmont offering houses from the $200s (https://www.newhomesource.com/homes/fl/gainesville-area/alachua-county). My estimate of 10 new houses a week might be anecdotal. Still, with the Fall 2025 Parade of Homes featuring 15 brand-new builds across Alachua neighborhoods, the influx is real—and it’s attracting more residents, eroding affordability even in “escape hatches” like Gainesville. It’s a relentless chase that turns Florida’s charm into a commodity.

Local Corruption: Developers Pulling the Strings in Miami Politics

Adding insult to injury, local politicians in Miami Beach and Miami-Dade County are deep in the pockets of real estate developers, creating a never-ending circus where public needs take a back seat to profit. In the 2025 elections, this was on full display: Eileen Higgins, who won the Miami mayoral runoff in December with a commanding lead, raked in significant campaign donations from commercial real estate lenders and was endorsed by the Miami Realtors PAC as “our choice to lead”. Higgins, a former Miami-Dade County Commissioner, edged out competitors in a field of 13 candidates, promising to tackle housing affordability—but her real estate backing raises eyebrows about whose interests she’ll truly serve. This beholdenness manifests in lax accountability for developers, who build massive condominium projects along Miami Beach and Biscayne Bay waterfront without footing the bill for essential infrastructure. Florida’s 2025 legislative session introduced new laws enhancing condo safety, transparency, and financial accountability following the Surfside tragedy. Still, enforcement remains spotty, shifting burdens like special assessments onto condo owners for aging buildings’ renovations. Projects like the revised 1250 West Avenue in Miami Beach highlight ongoing developer-city deals, while high-density developments on barrier islands exacerbate risks from hurricanes, erosion, and flooding—costs often borne by taxpayers through repeated infrastructure bailouts. A court decision blocking the demolition of Biscayne 21 condo underscores resistance to unchecked redevelopment. Yet, new launches like 72 Carlyle in North Beach show the pipeline persists without mandating developer-funded upgrades for roads, utilities, or resiliency measures. It’s a huge problem: Developers’ interests dominate, while the people’s needs—for sustainable, supported growth—are ignored. We must counter this by demanding stricter impact fees and independent oversight to break the cycle.

Smarter Alternatives: Relocating to Underrated Red States Like Mississippi and West Virginia

If the blue-state exodus is overwhelming hotspots like Florida, a more innovative solution lies in other red states that offer true affordability without the socialist-leaning policies plaguing blue areas. Mississippi and West Virginia stand out as under-the-radar options, boasting low costs, conservative governance, and ample room for growth without the price spikes. In Mississippi, the housing market remains one of the nation’s cheapest, with an average home value of $187,902 in 2025 (up just 0.3% year-over-year) and an affordability score where median incomes can comfortably cover payments. Jackson’s median sale price hit $268,945, with inventory up 3.4% to 8,983 homes statewide, signaling stabilization despite slow construction threatening long-term supply. For earners making $50,000-$60,000, house payments of $1,600-$1,900 are feasible, far better than blue-state burdens. With less regulatory red tape and a focus on economic freedom, it’s a red-state gem avoiding the socialist pitfalls. West Virginia shines even brighter, ranking third among the most affordable states for homeownership in 2025, with an average home value of $171,253 (up 1.4%) and a median of $185,000 in areas like Wheeling. Its affordability index stays above 150, meaning homes are well within reach, and lower prices compared to neighbors like PA, OH, and MD make it a budget stretcher. Though weak construction and a need for 25,000 more affordable rentals (especially for seniors) pose challenges, the market holds steady without the inflation driven by influxes seen elsewhere. These states prove that red alternatives exist beyond the hype—offering real relief from blue-state costs and policies.

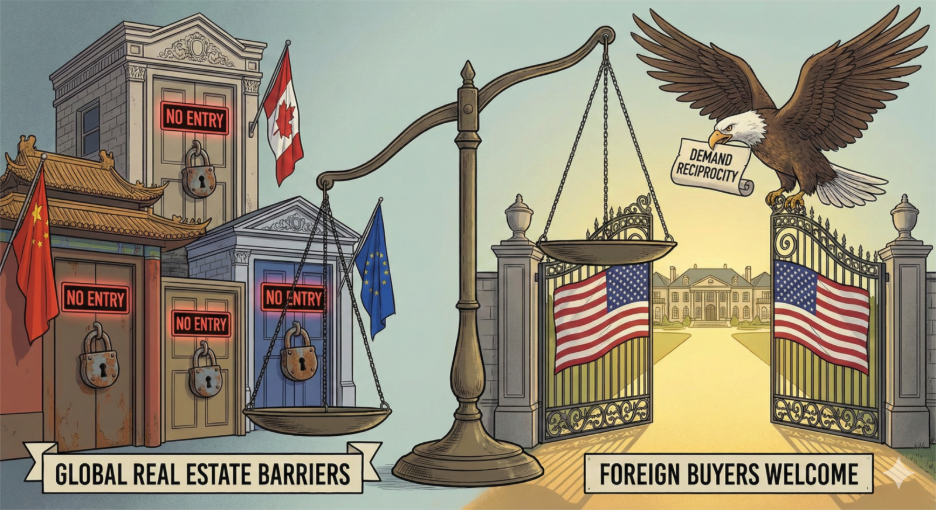

No Fair Play, No Purchase: The Case for Global Reciprocity

Here’s where it gets infuriating: While foreigners gobble up U.S. properties, many of their home countries slam the door on Americans. In China, foreigners can buy, but it’s leasehold (70 years max), requires residency or work visas, and faces heavy bureaucratic hurdles—eased slightly in 2025 for cross-border investments, but still restrictive (https://www.globalpropertyguide.com/Asia/China/Buying-Guide). What about South America? Brazil allows foreign ownership but caps rural land; Argentina requires approvals for border areas; Venezuela’s instability makes it a non-starter (https://www.globalpropertyguide.com/Latin-America). Canada? A 2025 extension of its foreign buyer ban on residential properties keeps non-citizens out, citing housing crises. Western Europe has no outright bans but high taxes; France restricts agricultural land; Germany imposes residency rules for certain buyers (https://www.globalpropertyguide.com/Europe). These nations are significantly more restrictive than the U.S., where federal laws are lax, though states like Florida (via SB 264) now ban Chinese-domiciled buyers from most properties (https://www.flsenate.gov/Session/Bill/2023/264). Other states have similar curbs, with nine enacting new ones in 2024. Why should we roll out the red carpet while they lock the door? It’s time for a tit-for-tat policy: If your country bars or burdens Americans, you face the same here. No more one-way deals with adversaries or opportunists.

Dirty Money, Dirty Deeds: Graft from U.S. Benevolence Funding the Invasion

Worse, some foreign buyers’ wealth smells fishy—likely from illegal, immoral sources, including graft siphoned from U.S. aid. USAID has been a “viper’s nest” of corruption accusations, with a 2025 OIG memo highlighting fraud in foreign programs . Samples abound: A USAID official and three execs pleaded guilty in June 2025 to a decade-long bribery scheme involving $250M in contracts. Fragmentation in fragile nations fuels corruption, with funds diverted to offshore accounts or elites. Trump’s admin called out mismanagement, but cuts to anti-corruption aid in 2025 risk more leaks (https://www.state.gov/foreign-assistance-resource-library/). If a country’s real estate market is “crap” (hello, China’s developer defaults), yet its citizens buy here with U.S.-subsidized graft, ban them. It’s not an investment; it’s laundering our benevolence against us.

The Trojan Horse in Our Heartland: China’s Farmland Menace

This foreign invasion doesn’t even touch China’s grip on U.S. ag land—around 277,000-380,000 acres in 2025, less than 1% total but strategically placed near military bases. Acquisitions near Grand Forks AFB or Yuma Proving Ground spark espionage fears—potential drone sites or sabotage hubs. USDA’s July 2025 plan to block Chinese buys calls it national security; add firms like WH Group controlling pork, and it’s control over our dinner tables. It isn’t benign; it’s a stealth threat, amplified by U.S. greed and naivety.

The Fall of Maduro: Potential Reversal of Venezuelan Diaspora and Its Ripple Effects on Miami Real Estate

Today, January 3, 2026, marks a seismic shift in Venezuelan history with the capture of Nicolás Maduro by U.S. forces, effectively ending his narco-dictatorship that has gripped the country since he succeeded Hugo Chávez in 2013. This dramatic event—announced by President Trump and involving a large-scale military operation—has sparked immediate celebrations among the Venezuelan diaspora, particularly in Miami-Dade County, where over 200,000 Venezuelans reside, forming one of the largest expatriate communities outside Venezuela. Doral, often dubbed “Doralzuela” for its heavy Venezuelan influence, erupted in joy, with flags waving and impromptu rallies, reflecting decades of pent-up frustration over the exodus that began under Chávez’s socialist policies in the late 1990s. The community has profoundly shaped Miami’s real estate landscape. Since the Venezuelan crisis escalated, affluent exiles fleeing economic collapse, hyperinflation, and political persecution have poured billions into South Florida properties, driving up demand in areas like Doral, where Venezuelan-owned businesses, restaurants, and high-end condos dominate. Doral’s median home prices have surged by more than 50% since 2020, partly fueled by this influx, turning it into a vibrant but increasingly unaffordable enclave for locals. The diaspora, numbering over 7 million globally with a significant portion in the U.S., has not only boosted luxury and commercial real estate but also created a cultural hub that rivals Caracas in Venezuelan flavor. However, Maduro’s fall could herald a reversal of this three-decade-long migration wave. Early reactions from the diaspora show a mix of euphoria and caution—while many celebrate, others express apprehension about Venezuela’s immediate future, fearing instability or a power vacuum. If the country stabilizes under a new government—potentially with U.S. support for democratic transitions—thousands could return home, seeking to rebuild lives and reclaim assets seized under the regime. This “return diaspora” might ease pressure on Miami’s overheated market, potentially leading to a softening of prices in Venezuelan-heavy neighborhoods like Doral. In the short term, we could see a dip in rental demand as families plan relocations. At the same time, long-term, a repatriation wave might free up inventory, benefiting first-time buyers squeezed out by foreign investment. Yet, it’s too soon to predict a mass exodus back to Venezuela. Many in the diaspora have deep roots in Miami—children in schools, established businesses, and U.S. citizenship or TPS status (Temporary Protected Status), which Trump has signaled could be revoked for Venezuelans now that the regime threat is gone. For some, scars of Chávez-Maduro era oppression run too deep, and they’ll wait for sustained reforms before uprooting again. In the meantime, this event underscores how global politics ripple into local real estate: Just as the Venezuelan crisis inflated Miami prices, its resolution could deflate them, offering a rare opportunity for market correction amid broader U.S. housing woes. This development reinforces the need for policies that protect American buyers first—perhaps by extending reciprocity rules to curb opportunistic foreign buyers during Venezuela’s transition. As a displaced Floridian myself, I hope this ends one chapter of suffering without creating new imbalances in our already strained markets.

Time to Reclaim Our Land

The U.S. real estate crisis isn’t inevitable—it’s policy failure meeting global opportunism. We’ve got to enforce reciprocity, crack down on graft-fueled buys, and prioritize Americans. The move was a wake-up call; let’s make it the last for families like mine. Demand better from Washington, Tallahassee, and Miami—before the American Dream becomes foreign-owned.