5 Best Cash Registers for Small Businesses in 2024

Ringing up sales is an essential part of daily retail operations. Small businesses will be better off using cash registers with a built-in card reader to support multiple payment types and serve various functions in addition to accepting payments, such as inventory management, tax calculations, and more advanced reporting.

It is also worth mentioning that most manufacturers of electronic cash registers (ECRs) have stopped production of their products, so finding support, repair, and replacement parts can be a challenge. If you prefer going with ECRs, ensure to get from a manufacturer that is still producing your preferred ECR model and has warranties and support in place.

Top cash register comparison

The best cash register for a small business should be affordable and have peripheral support, preferably built-in without an added cost. Being able to function and accept payments, even while not connected online, is an important feature.

The table below compares my top recommendation based on costs, peripheral hardware options, and offline capabilities.

Square Register: Best overall

Square Register is affordable, comes with several low-cost hardware peripheral options, and even gives a full set of sales, payment, inventory, and business management tools for free through its built-in POS software Square.

Square Register also has excellent user reviews and performed well in our own tests of the software. Upfront spending can challenge small business owners, but interest-free financing options are available. Its all-in-one solution can’t be beat, making it my top choice as the best POS-driven cash register for small businesses.

Why I chose Square Register

I like Square Register’s slick iPad-like POS display. Its well-thought-out minimalist design looks great on counters and even comes with a customer-facing card reader and display, meeting both merchant and customer needs.

Square has been a consistent and popular top choice among small business owners and experts alike for POS, payment processing, and hardware, so it is unsurprising that its primary retail POS kit, Square Register, is a top choice. Not only can you accept EMV, NFC, and traditional magstripe payments, but you can also accept gift card payments and create and send invoices from within Square’s software.

Square Register has an offline mode, so you’ll still be able to accept payments without an internet connection as long as you sync transactions made within 24 hours.

Pricing

- Hardware: $799 ($39 per month under financing).

- Optional accessories:

- Starts at $129 for a printer-driven cash drawer.

- Starts at $299 for receipt Printers.

- Starts at $34 for receipt printer paper.

- Starts at $119 for a barcode scanner

- Hardware comes with a two-year limited warranty.

Features

- Connectivity: Wi-Fi, Ethernet, Bluetooth, and offline mode are available (offline transactions must be uploaded online within 24 hours).

- Power supply: Power adapter included in kit; no battery included, so it needs to be connected to a power source at all times to operate.

- Payment types accepted: Chip cards (EMV), NFC cards, Apple Pay, Google Pay, Samsung Pay, Afterpay, Cash App Pay (QR code), and magstripe cards.

- Accessories: Cash drawer, receipt printer, bar code scanner, kitchen printer, kitchen countertop display, countertop mount (purchased separately).

- Number of products (PLUs & SKUs, plus departments or categories): Unlimited products; ideal for retail, appointments, and restaurants.

- Display screen size: Square Register is 13.5 inches (337mm); Customer display is 7 inches (178 mm).

- Overall dimensions: Square Register–12.5 x 10 x 5 inches (317.5 x 245 x 127 mm), 3.9 lbs.; Customer display–6.85 x 6.85 x 1.7 inches (174 x 174 x 44mm), 1.2 lbs.

- Local or cloud: Cloud installation, storage, and backup.

Pros and cons

|

|

Square Terminal: Best for portability

Square’s all-in-one mobile POS terminal, Square Terminal, can work as a standalone, portable business cash register or as a second screen to the Square Register and function as a built-in card reader for tap, dip, and swipe payments. The Square Terminal has a built-in battery designed to last all day. It is compact enough to carry handheld, making it ideal for accepting payments wherever — at table-side, pop-up activations, farmer’s markets, and more.

Why I chose Square Terminal

As part of the hardware exclusively offered by Square, the Square Terminal has built-in industry-specific POS software that can be easily installed at no cost, similar to the Square Register. I like that it is the most affordable POS hardware I feature in this list, making it perfect for small businesses on a budget.

You can accept payments using the hardware easily and expand accessories as needed.

Pricing

- Hardware: $299 ($27 for 12 months under financing).

- Optional accessories:

- $49 for Hub for Square Terminal

- Starts at $129 for a printer-driven cash drawer

- Starts at $299 for a receipt printer

- Starts at $34 for receipt paper

- Starts at $119 for a barcode scanner

- Hardware comes with a one-year limited warranty and 30-day free returns.

Features

- Connectivity: Wi-Fi, ethernet (requires Hub for Square Terminal), offline mode available (offline transactions must be uploaded online within 24 hours).

- Power supply: Power adapter included in kit with built-in battery designed to last all day.

- Payment types accepted: Chip cards (EMV), NFC cards, Apple Pay, Google Pay, Samsung Pay, Afterpay, Cash App Pay (QR code), Magnetic-stripe cards with free magstripe reader plug-in

- Accessories: USB hub, cash drawer, receipt printer, bar code scanner, touchscreen display, belt clip, countertop mount (purchased separately).

- Number of products (PLUs & SKUs, plus departments or categories): Unlimited products; ideal for retail, appointments, and restaurants.

- Display screen size: 5.5 inches (139.7 mm).

- Overall dimensions: 5.6 x 3.4 x 2.5 inches (142.2 x 86.4 x 63.55 mm); 417 g.

- Local or cloud: Cloud installation, storage, and backup.

Pros and cons

|

|

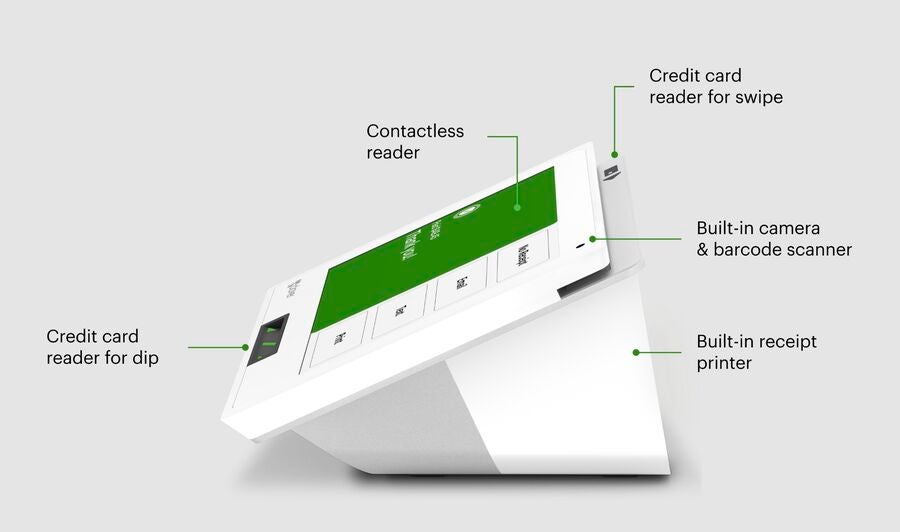

Clover Mini: Best for compact design and efficient use of space

Clover Mini was specifically designed for businesses with limited counter space. Its compact design, which can either be placed on counters or wall-mounted, is ideal for small retail shops, cafes, and quick-service restaurants.

The Clover Mini doesn’t compromise on functionality, either. This compact POS-driven cash register has a built-in card reader, camera scanner, and receipt printer — beating Square Register, which doesn’t have a built-in printer and scanner — and accepts multiple payment options, including EBT, QR codes, and split checks.

Why I chose Clover Mini

Designed to take up less space than a full Clover station but is made for ringing up payments in a fixed location, the Clover Mini, true to its name, fulfills the full role of a point-of-sale system. I like that it maximizes functionality with its big display screen and adds even more features like a PIN entry feature, barcode and QR scanning, and other features available to Clover proprietary hardware.

The only downside to Clover hardware is that pricing varies greatly depending on your vendor. The equipment is programmed to the vendor you purchase from, so you cannot reprogram it and take it with you if you switch processors.

However, if you do your research, you can choose a payment processing vendor that aligns with your business needs and purchase Clover hardware from them.

Pricing

- Hardware: $799 or $45 per month for 36 months. Pricing heavily depends on the partner provider you get the hardware from.

- Optional accessories: Swivel stand, PIN shield, kitchen printer, weight scale, barcode scanner, sticky label and thermal printers, cash drawer, and employee login cards (price available upon request).

- Hardware comes with a one-year limited warranty (manufacturer defects only).

Features

- Connectivity: Wi-Fi, ethernet, and LTE connectivity; offline mode available for up to seven days.

- Power supply: Power adapter included in kit; no battery is included for Clover Mini 3, so it needs to be connected to a power source at all times to operate; 2 GB RAM, 16 GB flash storage.

- Payment support: EMV, NFC, and magnetic stripe (MSR) readers; EBT, split checks, and QR codes through built-in camera.

- Accessories: Built-in thermal dot receipt printer; cash drawer is an optional paid add-on.

- Number of products (PLUs & SKUs, plus departments or categories): Up to 15,000 SKUs in-store; limits depend on the plan for e-commerce.

- Display screen size: 8 inches LCD color touchscreen.

- Overall dimensions: 12 x 10 x 6 inches; 2.3 lbs.

- Local or cloud: Cloud installation.

Pros and cons

|

|

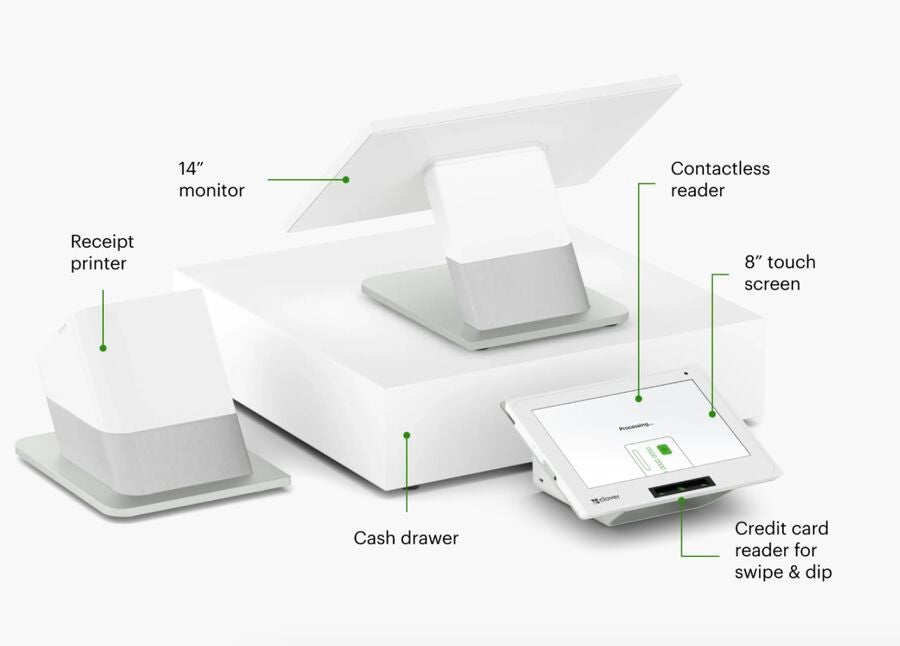

Clover Station Duo: Best for offline payment processing

Clover Station Duo is an all-in-one POS system well-suited for busy retail stores or restaurants with a fixed checkout location. It also comes with a stable offline mode that users can toggle on and off right from the POS register.

Businesses that want a comprehensive and integrated front-end and back-end solution will find Clover Station Duo the best option. It accepts various payment methods and has advanced back-office functions for inventory management and employee tracking.

Why I chose Clover Station Duo

The Clover Station Duo is the most expensive cash register featured in this list. While its starting price is steep, Clover cash registers have built-in software, so you don’t have to purchase them separately. Its display is slightly bigger than Square Register’s, and it even comes with a built-in cash drawer, printer, and scanner, all of which you need to buy separately with Square Register.

If you want a full POS-driven cash register with all the bells and whistles but want the freedom to go with your preferred payment processor, unlike the exclusivity of Square Register with Square, the Clover Station Duo is your best option.

Pricing

- Hardware: $1,799 or $170 per month for 36 months. Pricing heavily depends on the partner provider you get the hardware from.

- Optional accessories: Mini PIN shield, Mini PIN Entry Aid, cash drawer (price available upon request).

- Hardware comes with a one-year limited warranty (manufacturer defects only).

Features

- Connectivity: Wi-Fi, ethernet, and 4G/LTE, offline mode available.

- Power supply: Power adapter with built-in batteries (2) that can serve as backup in case of power interruptions (lasts up to four hours per battery) — printers will not operate on batteries; 2 GB RAM, 16 GB flash storage.

- Payment types accepted: Swipe, tap, and dip payments; QR codes (PayPal and Venmo).

- Accessories: Built-in high-speed thermal dot receipt printer, cash drawer (has a bill tray, coin tray, two keys, and a security cable), and dual 5 mega-pixel cameras with scanning software.

- Number of products (PLUs & SKUs, plus departments or categories): Up to 15,000 SKUs in-store; limits depend on the e-commerce plan.

- Display screen size: Merchant-facing is 14 inches; customer-facing is 8 inches.

- Overall dimensions: 20 x 20 x 20 inches; 8.03 lbs.

- Local or cloud: Cloud installation.

- Accessibility features: Volume control, voice assistant, stylus pen option, headphone connection ability, tactile PIN entry option.

- Virtual keypad for PIN entry.

Pros and cons

|

|

SAM4S ER-925: Best electronic cash register for peripherals

If you prefer a traditional cash register, SAM4S ER-925 is an electronic cash register that comes with a large cash drawer, a 150-key keyboard, an LED screen display for the operator and customer, and a built-in receipt printer. It provides more advanced features than the traditional ECRs I have tried but still meets the standards of an ECR. It can support up to 10,000 PLUs and 50 employee logins and produce detailed sales, financial, and employee reports.

SAM4S ER-925 comes with multiple ports, so it can easily be connected to plenty of peripheral hardware, such as card readers and barcode scanners.

Why I chose SAM4S ER-925

Aside from the fact that the manufacturer of this ECR still produces the model and provides support, I like that the SAM4S ER-925 has built-in hardware — a receipt printer, cash drawer, and a customer-facing display — which is very handy for small restaurants and retailers.

You can also extend functionality by adding a barcode scanner and support for up to 22,000 price look-up (PLU) codes instead of 3,500. You can also add a scale, which can work for businesses that need to weigh items, such as a small grocery store.

Pricing

The hardware cost varies by vendor and add-on inclusions but typically ranges from $500–$700. A separate merchant account is needed for payment processing. Rates vary per provider.

Features

- Connectivity: USB.

- Power supply: Power adapter; no battery is included, so it must always be connected to a power source to operate.

- Payment types accepted: Credit cards, debit cards, gift cards, and cash.

- Accessories: barcode scanner, scale, external card reader, external pole display, and Dallas Key port (purchased separately).

- Number of products (PLUs & SKUs, plus departments or categories): Tracks up to 3,500 PLUs (up to 22,000 with barcode scanner).

- Display screen size: Operator–2-line x 16 character alphanumeric backlit LCD; Customer–9-digit LED.

- Overall dimensions: 18 x 15 x 12 inches; 29.4 lbs.

- Local or cloud: Local installation.

- Detailed reports: Financial, employee, PLU by price level, sales by the hour, month, or chosen date.

- Up to 50 employee logins.

- 100 mix-and-match discount options.

Pros and cons

|

|

How do I choose the best cash register for my business?

A good cash register for small businesses is affordable and has features supporting scaling and growth. For most small businesses, a POS system is almost always an ideal solution over an electronic cash register because even the basic POS system has the functionalities you find in advanced ECRs.

That being said, small business cash registers, whether they are ECRs or POS cash registers, must have features needed to support your operations. Look for these features when shopping for a business cash register.

- Card reader: Built-in card readers, or the ability to integrate one, process credit, debit, and contactless payments.

- Report functionalities: Both ECRs and POS cash registers have some level of reporting capabilities. Not many ECRs can produce advanced reports for sales and stock counts, though, and only the SAM4S ER-925 can generate reports like this, which is the reason I included it in my top picks. Note: This type of report is a basic feature for most POS systems.

- Inventory management: A cash register for a business can help track and update stock in real time. All cloud-based POS systems have this feature, while ECRs have the rudimentary functionality.

- Tax function: Accurately calculating sales taxes or adding custom tax rates helps you fulfill tax and legal obligations.

- Peripheral support:

- Cash drawer: Even if they aren’t directly connected to your cash register, cash drawers are essential when accepting cash payments.

- Receipt printer: Most POS tools send digital receipts, but letting customers choose to have printed receipts is a good business practice.

- Barcode scanner: To increase the efficiency of ringing up sales, barcode scanners can help automatically manage inventory and reduce wait times in the cash register.

Methodology

To determine the best cash registers for small businesses, I considered nearly 20 electronic cash registers and point-of-sale solutions. I narrowed them down based on pricing, ease of use, and features needed to run day-to-day retail operations.

I considered the availability of peripherals for the cash registers, like barcode scanners and printers, and checked for offline mode functionality and backup power sources. I also looked into payment support, especially for digital payments (an increasing consumer preference).

Lastly, I checked for support availability, integrations, and warranties, as cash registers are crucial for a seamless business operation, and small business owners should be able to easily get support when needed.

Frequently Asked Questions (FAQs)

What should I look for when buying a cash register?

When looking for a best-buy cash register, look for one with built-in peripherals such as a card reader, receipt printer, and cash drawer. Check for inventory and tax functionalities and ask for available support and warranty.

What can I use instead of a cash register?

A POS system is the best alternative to a traditional cash register. POS systems accept payments, manage inventory, and produce detailed and advanced reports. Some include built-in peripherals such as receipt printers, scanners, and cash drawers.

How much does it cost to buy a cash register?

A handheld cash register typically starts at $299, and upfront costs for standalone devices or kits typically retail at $500 and up.